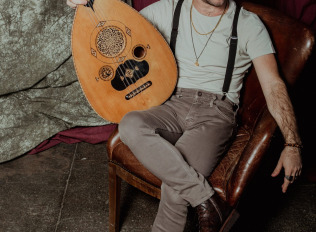

In a city where the skyline tells a story of ambition and reinvention, Eugène Choufani is a voice that understands Dubai‘s real estate pulse. Over the years, she has seen the emirate transform into a global hub of luxury, innovation, and community living—an evolution she approaches with both analytical rigor and human insight.

Her career path is anything but conventional: from the precision of neuroscience to the dynamism of real estate, Eugène brings a unique and refreshing perspective to the industry. Fluent in Arabic, English, and French, she bridges cultures and contexts with ease, pairing data-driven analysis with an instinct for understanding what ‘home' means to each client.

Her approach goes beyond property—it's about unlocking potential, aligning with personal goals, and ensuring her clients' investment journey is not just rewarding, but a long-term success story.

In this conversation, she shares her reflections on where Dubai's market stands today, where it is headed, and what it truly means to create a sense of home in one of the world's most dynamic cities, providing practical advice for investors and clients..

Q. Eugene, Dubai’s real estate market has evolved dramatically over the past two decades. How would you describe the current landscape?

A. 2024 hit a record AED 455B in transactions, and 2025 is already tracking at the same pace. But what matters is how uneven it feels on the ground: some areas are saturated with similar units, while others still move quickly. For example, a client of mine listed a 2-bedroom unit in Downtown with a Burj view, and we received three solid offers within a week. By contrast, a similarly priced unit in JVC sat for months with very few genuine leads. To me, that sums it up — the market is strong, but not everywhere equally.

Q. What trends are shaping the future of real estate in Dubai—luxury, sustainability, or perhaps new community concepts?

A. Luxury is resilient: villas on the Palm and prime apartments are still breaking price records, with some Downtown penthouses trading at AED 4,000+ per sqft.

Community demand is rising: families want 2–3 beds, schools, and parks. This is why villa communities like Arabian Ranches and Dubai Hills maintain 90%+ occupancy.

Sustainability is now the baseline: all new projects must comply with green building codes. Investors are starting to value service charges as much as views — efficient towers often save annually on running costs.

Q. Where do you see the strongest opportunities for investors today?

A. Established communities: Buying a 2-bed in Downtown or Marina might cost more upfront, but liquidity is stronger and exit risk is lower. Places like JVC can show 7–8% gross yields, but oversupply is real. I've seen investors struggle to resell units quickly. For me, that's why I'd call Downtown or Marina a risk-calculated investment — not the highest headline yield, but safer capital.

Mid-market rental stock: Villas and townhouses in good locations. When you invest in villa/townhouse stock, you're entering a smaller, less crowded slice of the market, which affects absorption, risk, and future value.

Selective off-plan: Only with tier-one developers, where supply risk is controlled.

Q. How do international buyers influence Dubai’s property market, and what are they looking for?

A. Foreign buyers represent over half the market. They're not just chasing returns — they're looking for:

Liquidity and recognition: buying in a market that they can exit from easily.

Visa and residency options linked to property.

Lifestyle credibility: walkability, mall access, waterfront views. One French client told me bluntly, “I can buy yield anywhere. I'm buying Dubai for the lifestyle and liquidity.”

Q. Many see Dubai as a transient hub, yet it’s becoming increasingly residential. How is that shift reflected in real estate development?

A. I feel it every week when families come to viewings. Ten years ago, many towers were built for transient buyers — studios and one-beds. Now, demand is for larger 2–3 bedroom layouts, storage space, and access to schools. Even in Downtown, the strongest demand now is for 2-beds with livable layouts, not shoebox one-beds.

What has changed recently is the behavior of renters. With rents climbing in some districts over the past two years, a lot of tenants are realizing they're better off buying. I've seen families who were paying AED 220,000 a year in rent decide to take a mortgage instead — their monthly outgoings are now similar, but they're building equity. That's the significant shift: Dubai is less transient, more owner-occupied, and developers are responding by prioritizing family-friendly, long-term homes over short-term investor stock.

Q. With the city aiming for greater sustainability, how is green building and smart technology changing the way projects are designed?

A. All new permits must comply with Al Sa'fat Green Building standards, a set of guidelines and regulations that promote sustainable and energy-efficient building design. That means lower service charges and smarter energy use, which directly impacts investors because OPEX is falling compared to older towers.

Q. What role does innovation—like AI, digital platforms, or proptech play in the way you approach real estate?

A. Enza, that is a great question. I rely on data daily — price per sqft, supply index, absorption rates, rental yields per building. But it's not just numbers; tech helps cut through the noise. When a client asks me about JVC vs Downtown, I can show them: JVC studios average AED 1,000–1,200 psf with 8% yields but higher vacancy, while Downtown averages AED 2,500 psf with 5–6% yields and faster turnover. That comparison makes the decision real. Proptech helps cut through noise so investors don't buy hype; they buy numbers.

Q. Dubai is often associated with luxury, but also with community living. How do developers balance exclusivity with accessibility?

A. Dubai has this unique way of mixing lifestyles in the same neighborhood. You'll see a branded penthouse selling at AED 4,000+ per sqft, sitting a short walk from mid-rise apartments where young families pay AED 1,200–1,500 per sqft. Developers do this intentionally: luxury creates prestige and global appeal, while mid-tier stock keeps communities alive and liquid.

I've seen it on the ground — one of my clients bought a luxury villa in Dubai Hills for AED 17M, while another family just a few streets away got a 3-bed townhouse for AED 4.2M. Both are in the same community, sending their kids to the same school, using the same parks. That's Dubai's balance: exclusivity without isolation.

Q. How important is cultural sensitivity in shaping spaces that attract both local and international residents?

A. It's absolutely central. Dubai works because it makes 200+ nationalities feel at home in the same city, and real estate plays a huge role in that.

When I walk clients through properties, I see how the smallest design details matter. An Emirati family once told me they couldn't imagine living without a closed kitchen for privacy. A European couple, in the same week, fell in love with an apartment because of its open-plan kitchen and expansive balcony, saying they could finally host friends the way they do back home. Both were right, and Dubai has space for both lifestyles.

Developers here have learned to listen: offering prayer rooms and women-only gyms for those who want them, green-shaded play areas for families, quiet corners for reflection, and buzzing cafés downstairs for those who crave connection. It's why communities like Dubai Hills or Arabian Ranches stay above 90% occupancy — they're not just houses, they're neighborhoods where different cultures live side by side and still feel comfortable in their own traditions.

For me, that's the beauty of Dubai real estate: it isn't one-size-fits-all. It's a mosaic, where every family — whether from Riyadh, Paris, Mumbai, or Toronto — can walk into a home and say, “This feels like it was designed for me.”

Q. What advice would you give to new investors entering Dubai’s market for the first time?

A. I'd say — mind the numbers. Don't just look at the property price; remember the 4% DLD, 2% agency, and service charges, so you're not surprised later.

Don't get blinded by high yields on paper. I've seen people chase 8% in oversupplied areas and regret it when they couldn't resell. A steady 5–6% in a liquid area can be far safer.

Stick with developers who deliver — delays can kill your return. And most importantly, think long-term.

And lastly, choose your advisor wisely. This market moves fast, and not every voice you hear has your best interest at heart. A good advisor should protect you from mistakes, not push you into a quick deal. My role is to make sure you invest with clarity and confidence, not just enthusiasm.

I say this because I've watched both the wins and the mistakes — and I'd rather my clients be protected than overpromised.

Q. If you had to make one prediction, what will Dubai real estate look like in 2035.

A. It will feel more like a city you live in full-time, not a transient hub. Families will dominate, green standards will be the norm, and areas like Creek and Dubai Hills will be as established as Marina is today. But the global heart — Burj Khalifa, DIFC, Marina waterfront — will still anchor demand.

Q. What does “home” mean to you personally?

A. For me, home is more than walls and square footage — it's the feeling of finally having a place that's yours. I think of my first-time buyers who walk in after signing and say, “This is where my kids will take their first steps,” or “This is the first kitchen that's truly mine.”

Home is security. It's knowing your rent can't suddenly jump, and every mortgage payment is building equity in something that belongs to you. It's that shift from feeling temporary to finally feeling anchored.

And honestly, it's emotional. When I see families stand on their new balcony, looking at the skyline, there's pride in their eyes. That's what home means to me — a space that gives you stability, dignity, and the freedom to build memories without wondering if it will all change next year.

Q. Do you have a favorite neighborhood or hidden corner of Dubai that inspires you?

A. Every area in Dubai has something special. The Palm gives you that calm by the sea, Dubai Hills feels like a family sanctuary, and Jumeirah has its timeless charm. “To be honest, as a young woman, nowhere resonates with me quite like Downtown.

There's something about standing at the foot of the Burj Khalifa, surrounded by energy, culture, and people from all over the world, that makes you feel part of something bigger. I can grab a coffee, walk by the fountains, or catch a show at the Opera, and it reminds me why people fall in love with this city.

For me, Downtown represents possibility. It's where ambition and lifestyle meet, and at this stage of my life, that blend of energy and inspiration is exactly what pushes me forward.

Q. When you’re not immersed in real estate, what spaces in the city give you the most joy or clarity?

A. For me, it's always the beach and the outdoors. There's something about Kite Beach — the sound of the waves, the morning Nike community runs, grabbing the best smoothies after — that clears my head completely. It's simple, but it reminds me why people choose Dubai not just to work, but to live.

I also love taking my bike along the Dubai Canal in the evening. Watching the skyline light up as you ride gives you this mix of calm and momentum — like you're recharging while still moving forward. Those moments keep me grounded, and they remind me that beyond the transactions and towers, Dubai is really about lifestyle and balance.

About the author

Subscribe

-

Hotel de Crillon: A Royal Past, A Daring Present

Hotel de Crillon: A Royal Past, A Daring Present -

In Conversation with Eugène Choufani

In Conversation with Eugène Choufani -

Sand, Souks and Stories, exploring Morocco

Sand, Souks and Stories, exploring Morocco -

Scidmore Sakura, Where Blossoms Bridge Worlds and Generations

Scidmore Sakura, Where Blossoms Bridge Worlds and Generations -

A Dazzling new Era for ancient wonders The Gran Egyptian Museum

A Dazzling new Era for ancient wonders The Gran Egyptian Museum

Leave a Reply